The mobile advertising landscape is evolving rapidly. While Google and Meta continue to dominate with their massive reach and sophisticated targeting, a third player is gaining traction: OEM (Original Equipment Manufacturer) advertising through device manufacturers like Xiaomi, Samsung, Vivo, and Oppo.

For app marketers in 2026, the question isn’t whether to advertise—it’s where to allocate your budget for maximum return. This comprehensive comparison examines three major traffic sources based on current industry data, helping you make informed decisions about your advertising strategy.

Understanding the Three Traffic Sources

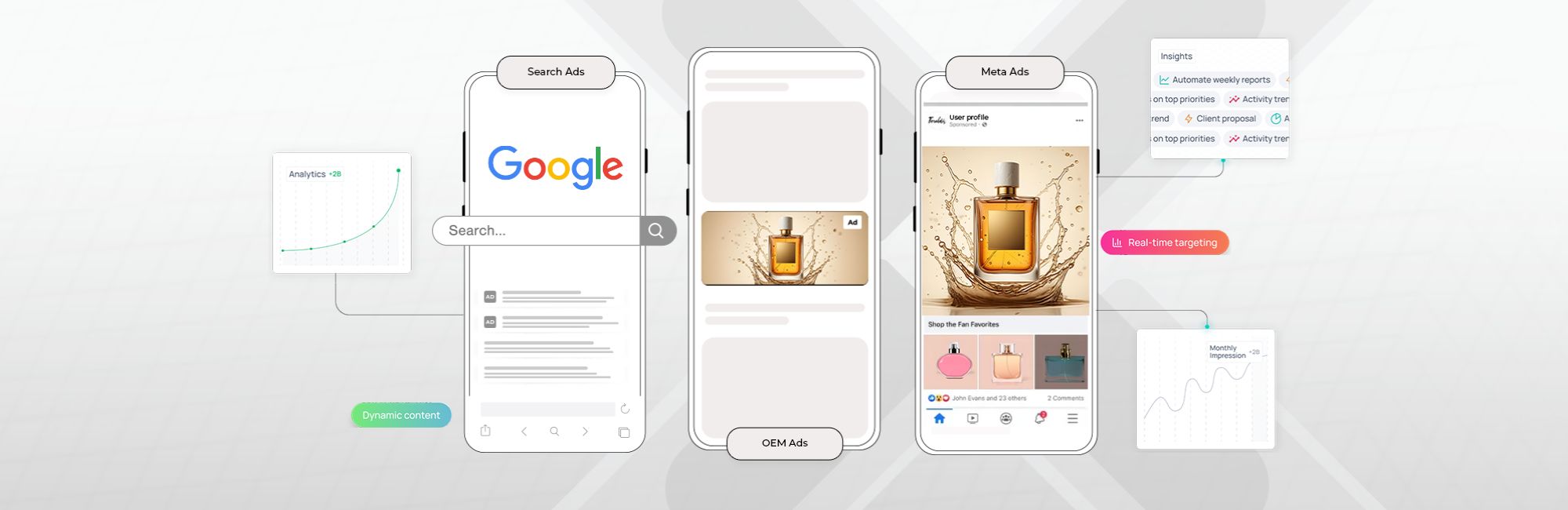

Google Ads: Intent-Driven Search Advertising

Google Ads captures users at the moment of intent. When someone searches for “fitness tracker app” or “food delivery near me,” they’re signaling clear purchase interest. Google’s ecosystem includes Search Network, Display Network, YouTube, and App Campaigns that automate placement across all Google properties.

According to multiple 2025 industry reports, average cost per click across Google Ads ranges from $2.69 to $5.26, depending on industry and campaign type. Search campaigns deliver the highest intent but also command premium pricing.

Meta Ads: Discovery-Based Social Advertising

Meta’s platforms (Facebook and Instagram) excel at creating demand rather than capturing it. Users scroll through feeds without actively searching for products, making Meta ideal for discovery, brand awareness, and interest-based targeting.

Recent data from WordStream and SuperAds shows Meta’s average CPC stabilized around $0.70 to $1.11 in 2025, with traffic campaigns performing particularly well. The platform reaches 2.8 billion monthly Facebook users and over 2 billion Instagram users globally.

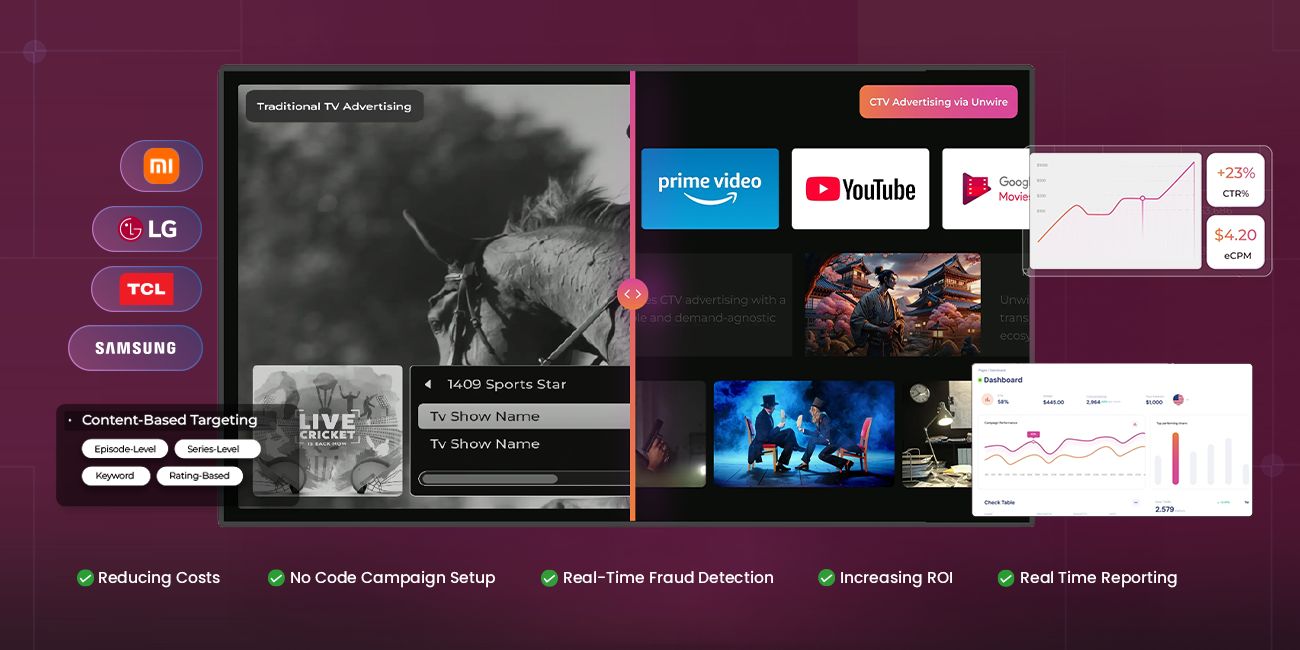

OEM Advertising: Device-Level User Acquisition

OEM advertising places apps directly on user devices through manufacturer partnerships. This includes factory preloads, recommended app placements, alternative app stores, and home screen promotions. Unlike Google and Meta, OEM ads appear as native device recommendations rather than traditional advertisements.

Xapads’ Performance Engine (Xerxes) provides access to 564 million MIUI monthly active users through Xiaomi partnership, along with connections to other major OEM networks including Vivo, Oppo, Samsung, and Transsion Palm Store.

Cost Comparison and Platform Economics

Google Ads Pricing Structure

Google operates on competitive auction-based bidding where multiple advertisers compete for the same search queries and placements. Industry benchmarks for 2025-2026 show:

- Average Search CPC: $2.69 to $5.26 across industries

- Average Display CPC: $0.63 to $1.31

- E-commerce Search CPC: $3.00 to $3.49

- Legal/Finance CPC: $8.00 to $9.00+

The auction system means costs fluctuate based on competition intensity. High-value keywords in competitive industries can exceed $10 per click.

Meta Ads Pricing Structure

Meta also uses auction-based pricing but generally delivers lower costs due to its discovery-based model:

- Average Traffic Campaign CPC: $0.50 to $0.70

- Average Lead Generation CPC: $2.50 to $3.00

- Facebook Feed CPC: $1.09 to $1.15 (2025 average)

- Instagram Feed CPC: $3.35

- Instagram Stories CPC: $1.83

Meta’s costs increased modestly in Q4 2025 during the competitive holiday season but have shown relative stability compared to Google.

OEM Platform Pricing

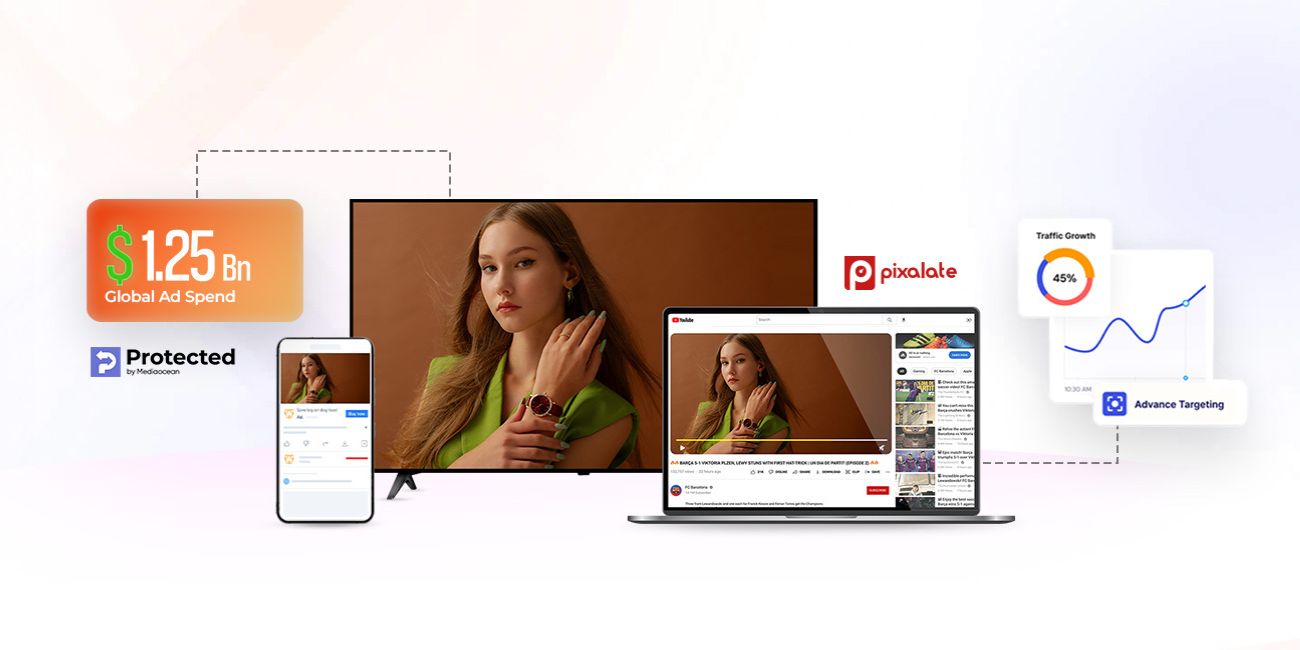

OEM advertising typically operates on performance-based models (CPI, CPA) rather than pure auction systems. Based on Xapads Performance data:

- Fraud Rate: <0.80% (verified through HUMAN and Pixalate partnerships)

- Click-to-Install Ratio: >10%

- Performance-Based Pricing: Costs tied directly to installs and actions rather than clicks

The performance-based model means advertisers pay for results, not just traffic. This can provide better cost predictability compared to auction-based platforms.

Fraud Protection and Traffic Quality

Industry-Wide Fraud Challenges

Digital advertising fraud represents a significant challenge across all platforms. According to Statista, global digital ad fraud costs reached $88 billion in 2023 and are projected to hit $172 billion by 2028—nearly doubling in five years.

Mobile advertising fraud rates vary by platform and implementation. Statista data from Q2 2022 showed iOS had a 15.4% fraud rate, though these figures fluctuate based on detection methods and protection systems deployed.

Platform-Specific Fraud Protection

Google’s Approach: Google employs sophisticated fraud detection but operates across an enormous, complex ecosystem. Invalid traffic remains a concern, particularly across Display Network and Video Partner inventory.

Meta’s Approach: Meta’s closed ecosystem provides more control over traffic quality. The platform’s fraud detection systems continuously evolve, though social media platforms face unique challenges with fake accounts and coordinated inauthentic behavior.

OEM’s Advantage: OEM advertising’s direct device-to-user connection eliminates many fraud vectors present in traditional digital advertising. According to Xapads’ verified performance metrics:

- 99%+ fraud-free impressions (verified through HUMAN and Pixalate)

- 100% post-bid protection

- 90%+ viewability validation accuracy

The direct installation path—from device manufacturer to user—removes intermediary layers where fraud typically occurs.

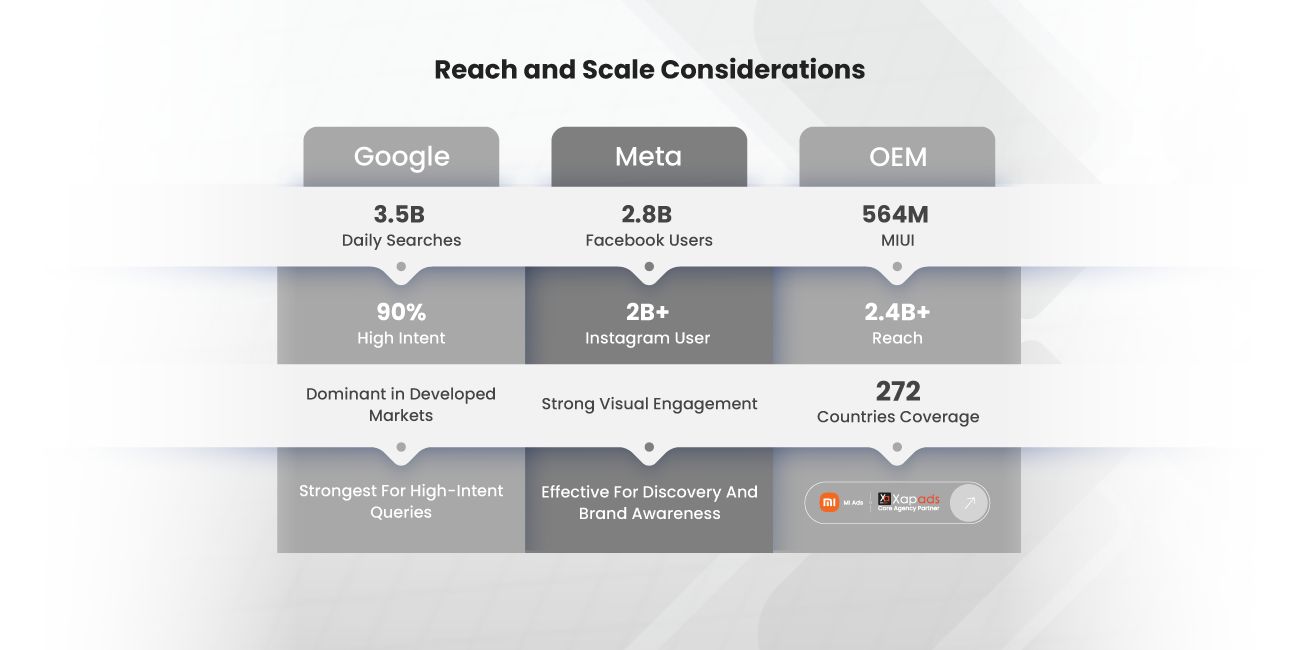

Reach and Scale Considerations

Google’s Massive Search Ecosystem

- 3.5 billion daily searches globally

- 90% of internet users reached via Display Network

- Dominant in developed markets

- Strongest for high-intent queries

Meta’s Social Network Scale

- 2.8 billion monthly Facebook users

- 2+ billion Instagram users

- Strong visual engagement

- Effective for discovery and brand awareness

OEM’s Growing Market Presence

Xapads’ OEM network provides:

- 564 million MIUI monthly active users (Xiaomi)

- 2.4 billion+ global reach across multiple OEM partners

- 272 countries coverage

- Mi Global Core Agency Partner status

OEM advertising is particularly strong in emerging markets where alternative app stores and device-native recommendations play a larger role in app discovery. These markets represent significant growth opportunities for app marketers.

When to Choose Each Platform for Your App

Choose Google Ads When:

Best For:

- High-intent user acquisition

- Search-based discovery

- Immediate conversions

- Brand keyword protection

- Users actively seeking solutions

Considerations:

- Premium pricing in competitive verticals

- Requires sophisticated keyword strategy

- Best ROI when user intent is high

- Auction competition can drive costs up

Example Use Case: A tax preparation app launching during tax season benefits from capturing users searching “file taxes online” or “best tax software.”

Choose Meta Ads When:

Best For:

- Brand awareness campaigns

- Visual storytelling

- Interest-based targeting

- Creating demand for new products

- Building consideration

Considerations:

- Lower costs than Google Search

- Users aren’t actively searching

- Requires compelling creative

- Longer conversion funnels

Example Use Case: A new fitness app can use Meta’s targeting to reach users interested in health, wellness, and lifestyle content, building awareness before users actively search for solutions.

Choose OEM Advertising When:

Best For:

- Android app user acquisition

- Cost-efficient scaling

- Fraud-free verified installs

- Emerging market expansion

Considerations:

- Limited to Android ecosystem

- Requires creative adapted for device interfaces

- Works through self-serve platforms like Xerxes

- Strong in specific geographic markets

Example Use Case: A mobile game or utility app targeting growth in India, Southeast Asia, or Latin America can leverage OEM partnerships to reach users during device setup and through native recommendations.

Combining Platforms for Maximum Impact

The most effective strategies don’t rely on a single platform. Instead, smart marketers combine platforms based on their strengths:

Upper Funnel (Awareness):

- Meta for visual storytelling and broad reach

- Google Display for contextual awareness

- OEM for device-level presence

Mid Funnel (Consideration):

- Meta for retargeting engaged users

- Google Search for comparison queries

- OEM for recommended app placements

Lower Funnel (Conversion):

- Google Search for high-intent captures

- Meta for optimized conversion campaigns

- OEM for direct installs with verified users

Real Performance Metrics: What to Expect

Industry Benchmarks by Platform

Google Search Ads:

- Average CTR: 3.17% to 6.66%

- Average Conversion Rate: 3.75% to 7.52%

- Average CPA: $48.96 (Search), $75.51 (Display)

Meta Ads:

- Average CTR: 1.49% (Facebook), 0.22-0.88% (Instagram Feed)

- Average Conversion Rate: Varies by objective

- Average CPM: $15.74 to $25.22 (seasonal variation)

OEM Performance (Xapads Data):

- +18% ROAS uplift with AI-led optimization

- 12-15% retention uplift on CPI model

- 4.7/5 Q-Score (Global OEM benchmark)

- 0.8x lower churn vs industry average

App Category-Specific Benchmarks

From Xapads’ performance data across industries:

Gaming:

- Average CAC: $13-$15

- Day 1 Retention: 15-20%

- First Purchase: 8-10%

E-commerce/Shopping:

- Install → Registration: 30-35%

- Install → First Order: 10-15%

- Day 7 Retention: 18-22%

Fintech:

- Install → Account Creation: 30-40%

- Account → KYC Completion: 15-20%

- Day 7 Retention: 15-20%

Future Outlook: 2027-2030 Advertising Trends

Privacy and Targeting Evolution

Cookie deprecation and privacy regulations favor platforms with first-party data. OEM manufacturers own device-level data, providing targeting capabilities that don’t rely on third-party cookies. Google and Meta continue adapting to privacy requirements through contextual targeting and consent-based solutions.

Market Projections

According to Statista, mobile advertising will represent 69.61% of total digital ad spend by 2028, up from current levels. The in-app advertising market is projected to exceed $462 billion, with significant growth in emerging markets where OEM influence is strongest.

Platform Evolution

- Google: Increased automation through Performance Max and AI-driven optimization

- Meta: Enhanced measurement and privacy-focused targeting solutions

- OEM: Expanding alternative app store ecosystem and device-native ad formats

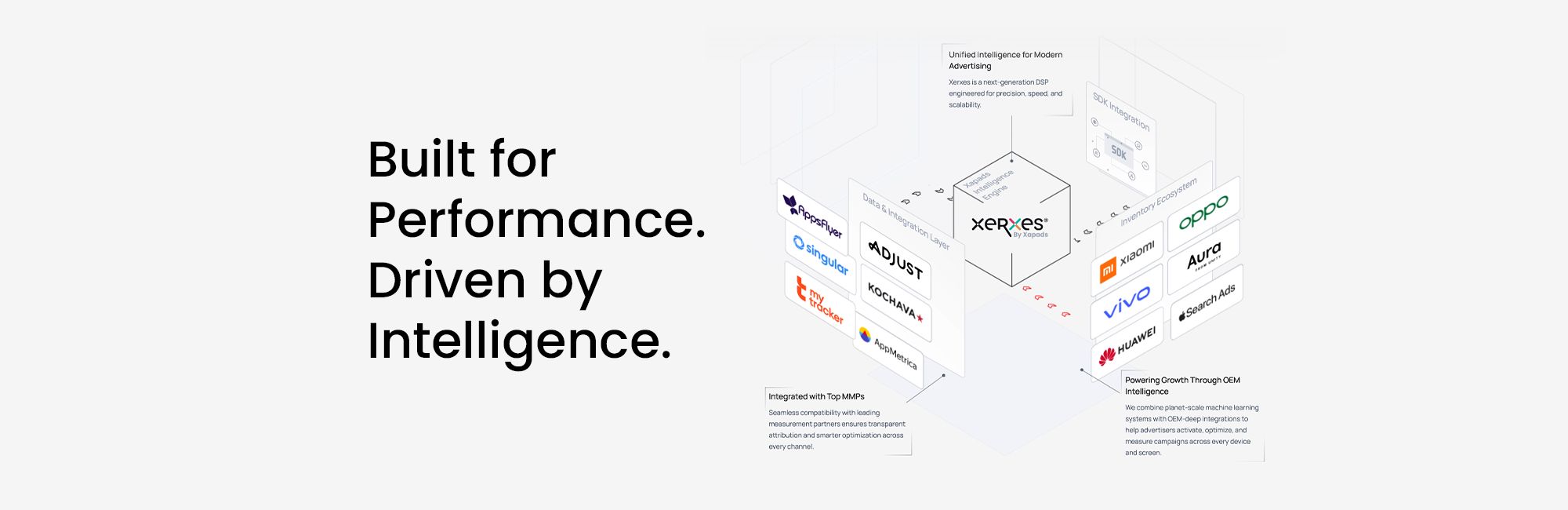

The Xerxes Advantage for OEM Advertising

For marketers interested in exploring OEM advertising, Xapads’ Xerxes platform provides:

Self-Serve Platform Features:

- Access to 564M+ MIUI users and broader OEM network

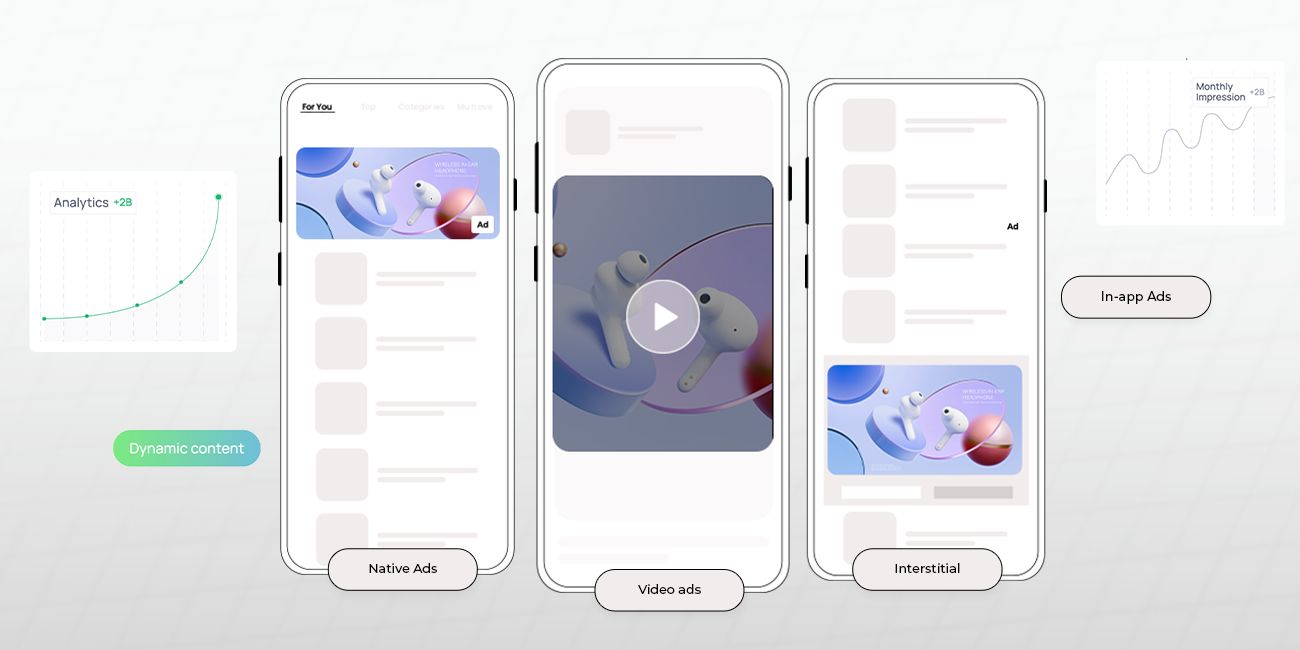

- Multiple buying models: CPM, CPC, CPI, CPA

- Support for OEM, Native, Video, and Interactive ad formats

- Real-time performance reporting

- Brand safety controls via HUMAN and Pixalate verification

Verified Performance:

- AI/ML-enabled optimization engine

- <0.80% fraud rate

- 10% click-to-install ratio

- Transparent, data-driven technology

Recognition:

- Award-winning platform recognized by IAB, MMA, and IAMAI

- Trusted by Fortune 500 brands and emerging businesses

- Mi Global Core Agency Partner

The Bottom Line on OEM vs Google vs Meta

In 2026, the answer to “which traffic source is best” depends entirely on your specific goals, budget, and target audience:

Google Ads excels at: High-intent search captures, immediate conversions, users actively seeking solutions

Meta Ads excels at: Brand building, visual storytelling, discovery, cost-efficient reach

OEM Advertising excels at: Fraud-free installs, cost efficiency, emerging market reach, device-level presence

The most successful mobile app marketers don’t choose one platform exclusively. They build diversified strategies that leverage each platform’s strengths:

- Use OEM for cost-efficient, fraud-free base user acquisition

- Deploy Google Search to capture high-intent users

- Leverage Meta for brand awareness and retargeting

Start by testing all three platforms with modest budgets. Measure performance rigorously using consistent attribution and tracking. Scale investment in channels that deliver your specific KPIs at acceptable costs. And remember: the best advertising strategy evolves continuously based on data, not assumptions.

The mobile advertising landscape offers more options than ever. By understanding each platform’s strengths and limitations, you can build campaigns that deliver genuine ROI in 2026 and beyond.