Programmatic advertising reached $802 billion globally in 2024, and choosing between a Demand Side Platform (DSP) and an ad network now determines whether your campaigns succeed or fail. By 2026, programmatic methods will account for 90% of all digital display ad spending worldwide, making this decision more critical than ever.

If you are reading this, you are probably evaluating platforms for your next campaign, wondering which technology gives you better control, lower costs, and higher returns. This guide compares DSPs and ad networks across every dimension that matters in 2026, helping you make an informed decision backed by current data and real performance benchmarks.

Understanding What Each Platform Actually Does

Ad Networks: The Traditional Middleman

Ad networks act as brokers between advertisers and publishers. They collect inventory from multiple websites and apps, package it into categories like sports, lifestyle, or news, and sell these bundles at fixed prices.

Think of ad networks as wholesale distributors. They buy ad space in bulk from publishers, organize it by topic or audience, and resell it to advertisers with a markup. You get simplified access to multiple sites through one platform but limited control over exactly where your ads appear.

DSPs: Technology for Direct Market Access

A DSP is software that connects you directly to ad exchanges, supply side platforms (SSPs), and publisher inventory. You bid on individual ad impressions in real time using data to determine what each impression is worth to your campaign.

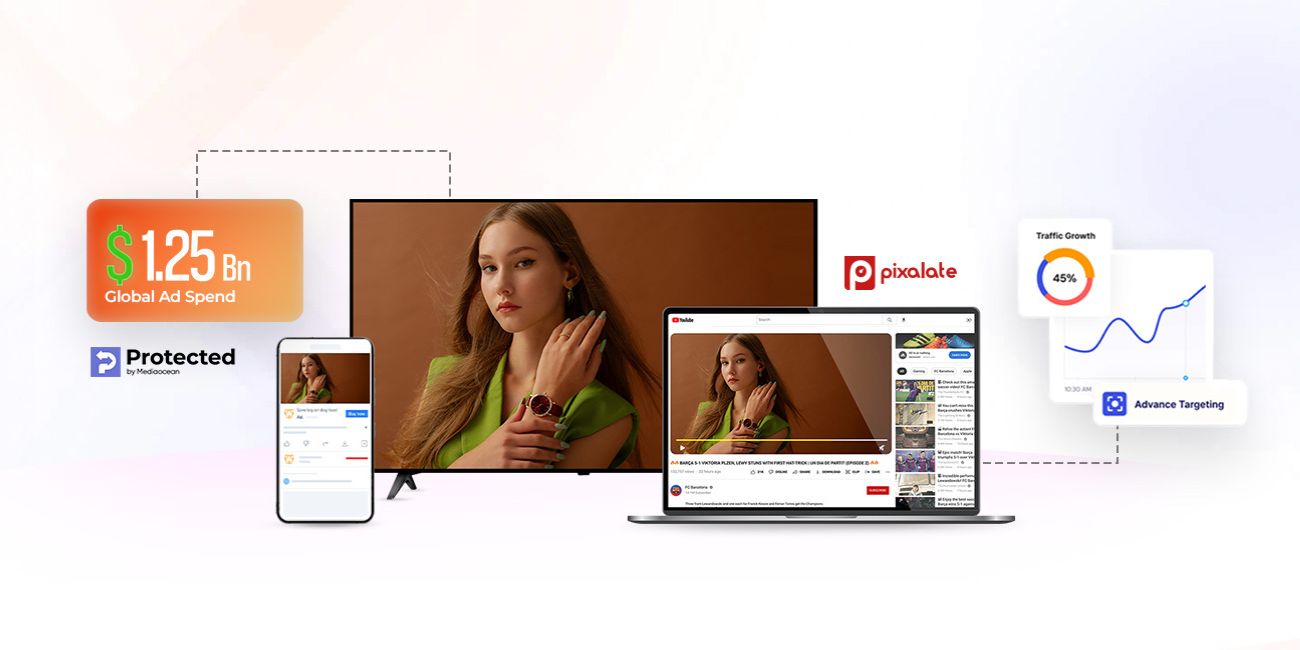

DSPs use automation and AI to evaluate billions of bid requests per second, selecting the best yplacements based on your targeting criteria and budget. The global programmatic advertising market reached $802.34 billion in 2024 and continues growing at 22.8% annually.

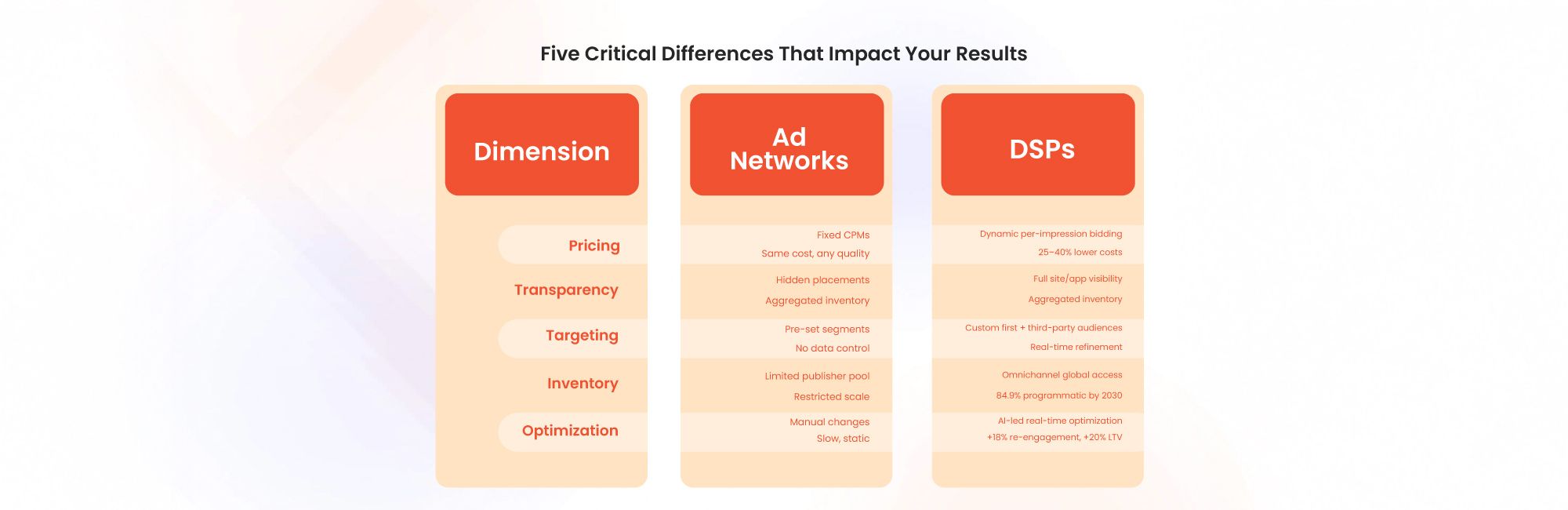

Five Critical Differences That Impact Your Results

1. Pricing Models: Fixed Rates vs Dynamic Bidding

Ad Networks: Charge fixed CPM rates regardless of impression quality. You pay the same price whether your ad appears on a premium site with engaged users or a lower quality placement with questionable traffic.

DSPs: Enable dynamic bidding where you set the value for each impression. Platforms like Xaprio DSP allow you to bid higher for valuable placements reaching your ideal customer and lower for less relevant impressions. This flexibility typically reduces costs by 25 to 40% compared to fixed rate buying.

2. Transparency: Hidden Placements vs Complete Visibility

Ad Networks: Often mask where your ads actually run. Networks aggregate inventory across many publishers before selling it, making it difficult to verify placement quality or ensure brand safety.

DSPs: Provide impression level transparency. You see every website or app where your ad runs, audience demographics reached, viewability rates, and exact costs paid. Xapads Media delivers 99% fraud free impressions with full supply path transparency through partnerships with Human and Pixalate.

3. Targeting Capabilities: Pre-Set vs Custom Audiences

Ad Networks: Offer predefined audience segments. You select from existing categories but cannot modify them or build custom segments using your first party data.

DSPs: Enable precision targeting using multiple data sources. Xerxes, Xapads’ mobile performance DSP, combines first party and third party data points across user interests, location, devices, telecom data, and behavior patterns. You build custom audiences, test different segments, and refine targeting based on real time performance.

4. Inventory Access: Limited Supply vs Global Reach

Ad Networks: Provide access only to their curated publisher relationships. Your reach is limited to whatever inventory that specific network controls.

DSPs: Connect to multiple ad exchanges, SSPs, and private marketplaces simultaneously. Advanced platforms like Xaprio DSP deliver omnichannel access across CTV, Display, Video, Native, OEM, and Rich Media through unified technology. By 2030, 84.9% of advertising revenue will be generated through programmatic channels.

5. Optimization: Manual Adjustments vs AI Automation

Ad Networks: Require manual campaign management through account representatives. Changes can take days to implement and lack the precision of automated systems.

DSPs: Use AI and machine learning for real time optimization. The system automatically adjusts bids, shifts budget to better performing placements, and tests creative variations without manual intervention. Xerxes mobile DSP achieves 18% higher re-engagement rates and 20% LTV improvement through AI-led optimization.

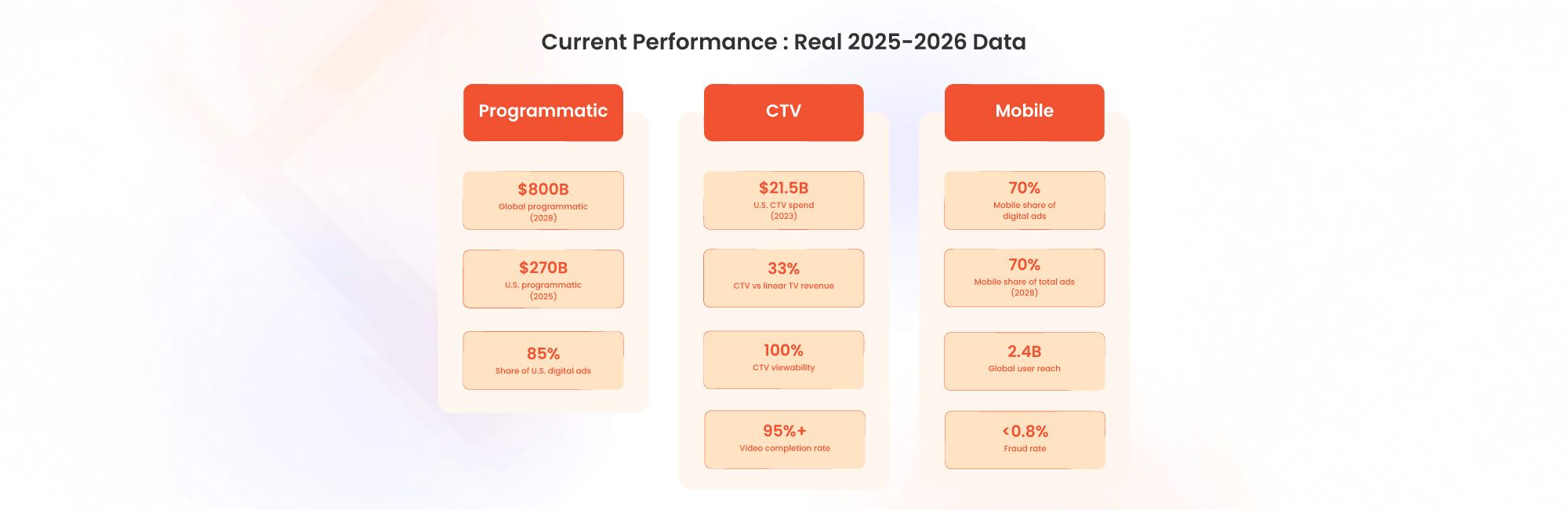

Current Performance: Real 2025-2026 Data

Understanding actual performance helps you make data-driven decisions:

Market Growth Indicators

Global programmatic ad spending is projected to approach $800 billion by 2028, with the United States accounting for over 40% of global programmatic investments. In 2025, U.S. programmatic ad spend is expected to surpass $270 billion, representing approximately 85% of the country’s digital ad spend.

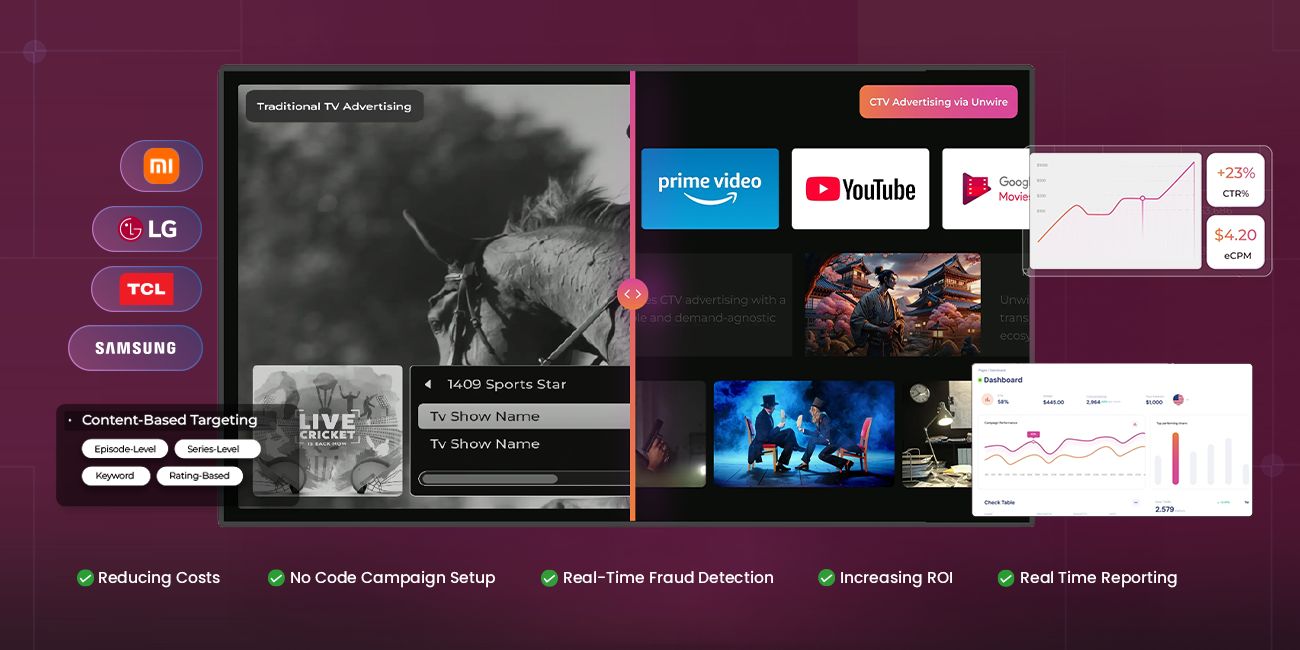

Connected TV Dominance

CTV programmatic ad spend in the U.S. reached $21.5 billion in 2023, roughly one third of linear TV ad revenues. Platforms like Unwire, Xapads’ CTV advertising platform, deliver 100% viewability and 95%+ video completion rates across premium CTV inventory including OEMs, FAST channels, and streaming apps.

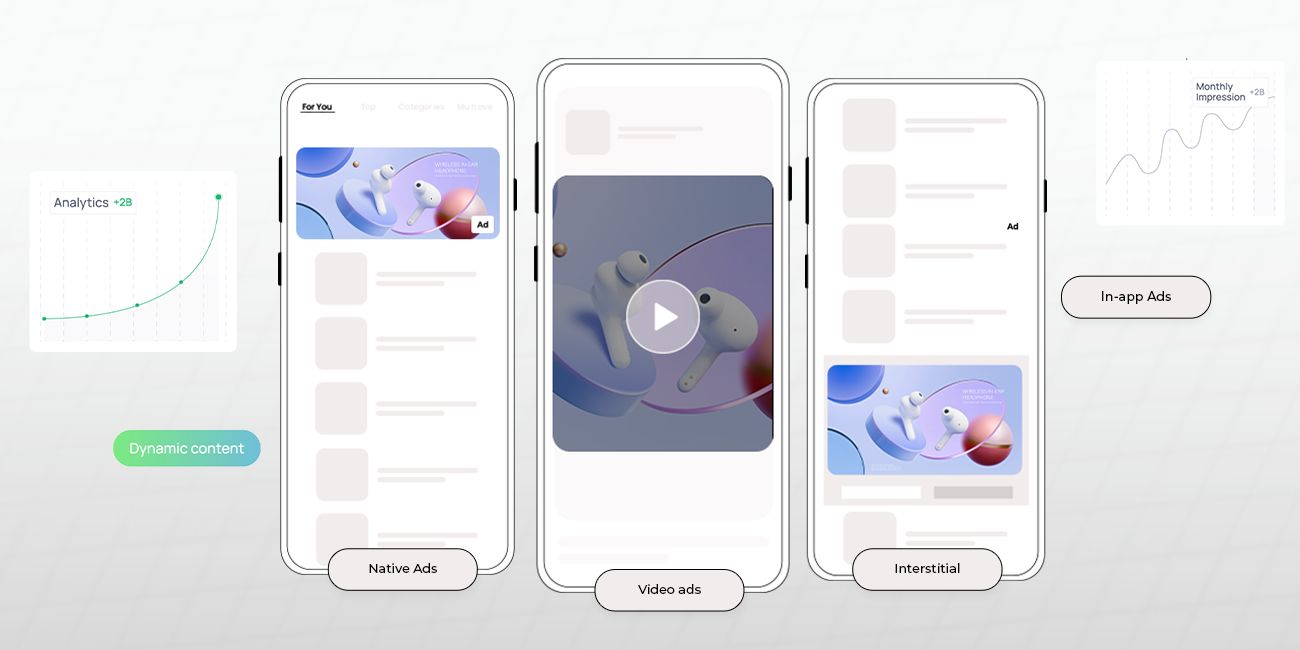

Mobile Advertising Growth

Mobile advertising accounts for 70% of total digital ad revenue, with 70% of total ad spending generated through mobile by 2028. DSPs optimized for mobile like Xerxes access 2.4 billion users globally with less than 0.8% fraud rates.

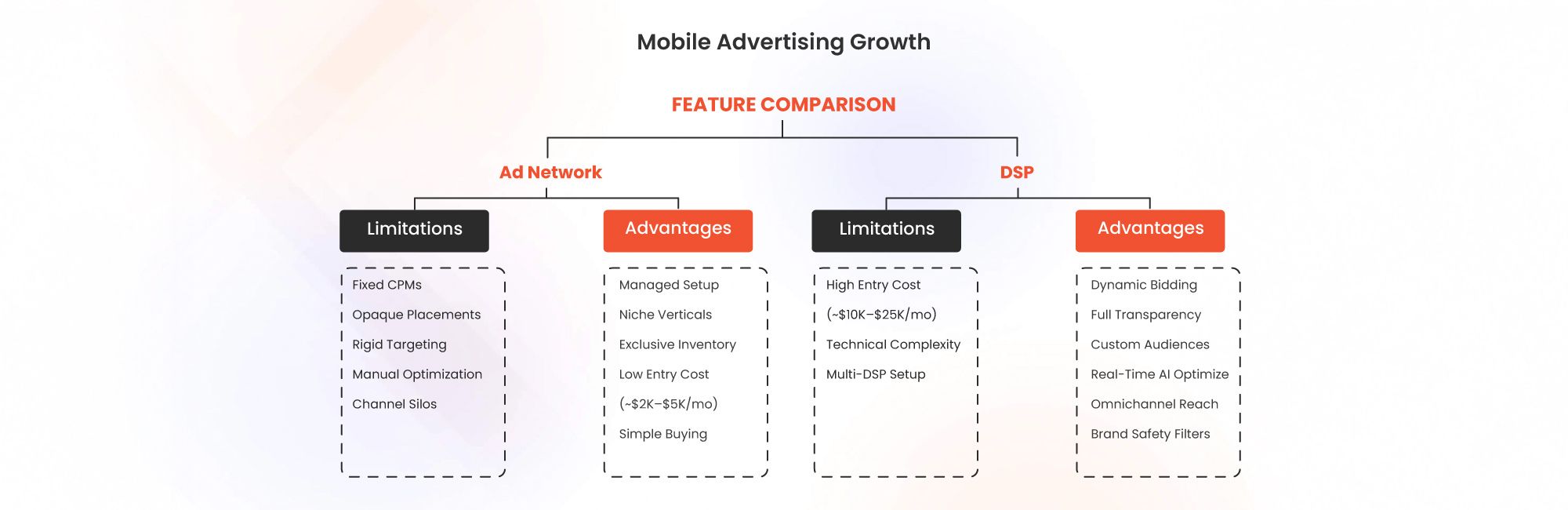

Feature Comparison: What You Get With Each Platform

Ad Network Advantages

Simplified Management: Account managers handle campaign setup and optimization, reducing your team’s workload.

Niche Vertical Access: Specialized networks focused on specific industries (healthcare, finance, B2B) deliver highly relevant audiences through curated publisher relationships.

Premium Publisher Inventory: Some elite publishers exclusively sell inventory through select ad networks, providing access to placements unavailable through open exchanges.

Lower Minimum Spend: Entry level budgets start around $2,000 to $5,000 monthly, making networks accessible for smaller advertisers.

Ad Network Limitations

Fixed CPM Pricing: All impressions cost the same regardless of quality or value.

Limited Transparency: You cannot verify exactly where ads run or assess individual placement performance.

Pre-Defined Targeting: Audience segments cannot be customized or updated based on your data.

Manual Optimization: Changes require coordination with account managers and lack real time responsiveness.

No Cross-Channel Coordination: Campaigns run in silos without unified measurement or optimization across channels.

DSP Advantages

Dynamic Bidding: Set different bid values based on impression quality, audience match, and placement context. Xaprio DSP enables sophisticated bid strategies aligned with campaign KPIs.

Complete Transparency: View impression level data including exact placements, costs, viewability metrics, and audience demographics. Xapads Media provides 100% valid supply path optimization with post-bid protection.

Advanced Targeting: Build custom audiences using first party data, behavioral signals, contextual information, and AI-driven predictions. Target users across devices, locations, interests, and purchase intent stages.

Real-Time Optimization: AI automatically adjusts bids, budgets, and placements based on performance signals. Xerxes delivers automated A/B testing, creative optimization, and LTV-based bidding.

Omnichannel Capabilities: Manage campaigns across CTV, Display, Video, Native, OEM, and Rich Media from unified platforms. Xaprio provides seamless cross-device targeting and unified reporting.

Brand Safety Protection: Integrated verification from partners like Human and Pixalate filters MFA sites, invalid traffic, and unsafe content. Xapads Media maintains 99%+ fraud free delivery with 95%+ brand safety rates.

DSP Limitations

Higher Minimum Spend: Self-service platforms typically require $10,000 to $25,000 monthly budgets.

Technical Complexity: Teams need training to use advanced features and optimization tools effectively.

Multi-Platform Necessity: Nearly 70% of large advertisers now operate across multiple DSPs to access different inventory sources and capabilities.

Real Campaign Performance: Verified Results

Understanding actual outcomes helps set realistic expectations:

Attach Case Studies

Brand Awareness Campaign Results

Pulse, Xapads’ AI-powered contextual YouTube targeting solution, delivered these results for major brands:

MyCo Community Building:

- 2 million+ impressions

- 1.5 million+ reach

- 1.7 million+ views

- 85%+ view-through rate

Amazon Fresh Launch:

- 8.9 million+ impressions

- 7.2 million+ views

- 50,000+ clicks

- Brand safe contextual placement

Redbell Ramadan Campaign:

- 2 million+ impressions

- 1.3 million+ views

- 12,200+ clicks

- Context-driven audience targeting

CTV Campaign Benchmarks

Unwire CTV platform consistently achieves:

- 100% viewability across premium channels

- 95%+ video completion rates

- 8 to 10 minutes ads per hour maximum frequency

- 15+ second average ad duration

Mobile Performance Benchmarks

Xerxes mobile DSP delivers industry-leading metrics:

- 18% higher ROAS with AI-led optimization

- 12 to 15% retention uplift on CPI model

- 0.8x lower churn rate on average

- 4.7 out of 5 quality score on global OEM benchmark

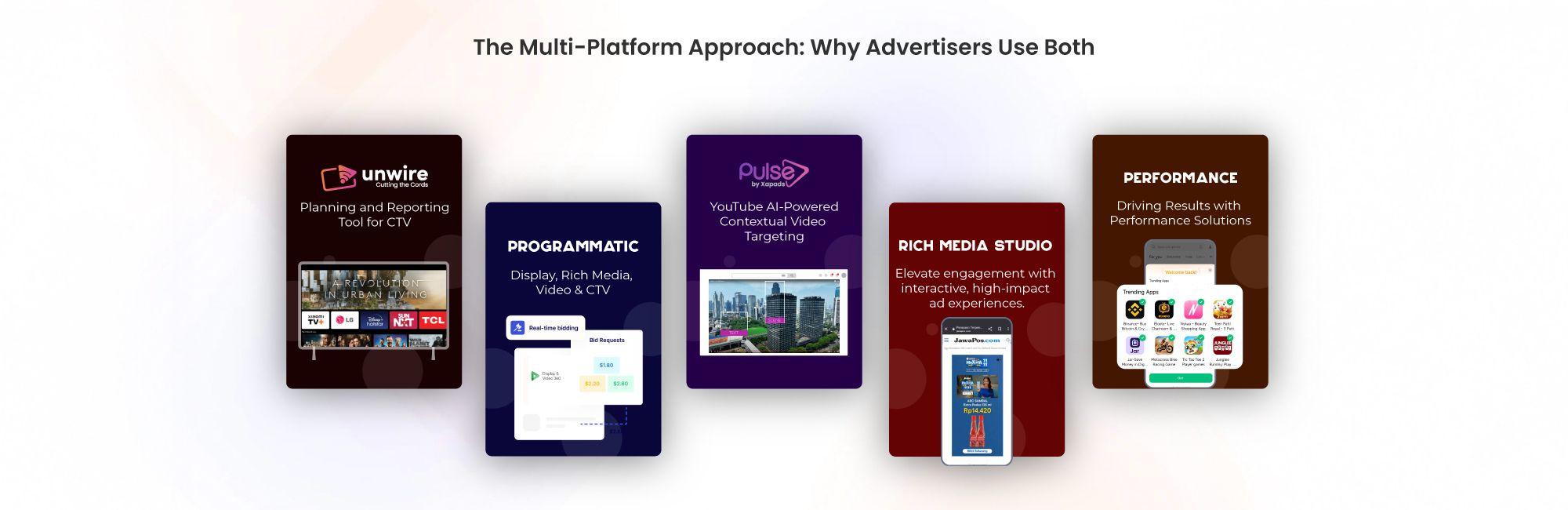

The Multi-Platform Approach: Why Advertisers Use Both

Nearly 70% of large advertisers operate across multiple DSPs because no single platform offers complete coverage. Smart media strategies combine different technologies:

Xaprio DSP: For omnichannel campaigns with CTV-first approach, green supply path optimization, brand safety protection, and unified cross-channel performance management.

Xapads Media: For overall programmatic advertising performance, comprehensive demand-side solutions across global markets, and verified fraud-free delivery.

Xerxes: For mobile performance campaigns, OEM advertising, app install optimization, and LTV-focused user acquisition.

Pulse: For AI-powered contextual targeting on YouTube with GARM-compliant brand safety and frame-level content analysis.

Unwire: For premium CTV advertising across OEMs, FAST channels, and streaming apps with advanced contextual targeting.

This multi-platform approach diversifies risk, maximizes inventory access, and prevents dependence on any single vendor.

Cost Analysis: Real Investment Requirements

Ad Network Costs

Fixed CPM: $3 to $8 depending on category, geo and publisher quality Platform Fee: Hidden in CPM markup Account Management: Included in pricing Minimum Spend: $2,000 to $5,000 monthly Total Effective Cost: $4 to $10 CPM

DSP Costs

Variable CPM: $0.50 to $15 based on impression value and competition. Platform Fee: 10 to 20% of media spend or fixed monthly fee Self-Service Available: Reduces management costs Minimum Spend: $2,000 to $25,000 monthly Total Effective Cost: $1 to $6 CPM for optimized campaigns

For advertisers spending $10,000 or more monthly, DSPs typically deliver better value through more efficient targeting and automated optimization.

Future Trends Shaping 2026-2030

AI-Powered Campaign Management

Machine learning will handle increasingly complex decisions including bid optimization, creative selection, and audience discovery. By 2030, programmatic will account for 84.9% of advertising revenue.

Contextual Targeting Evolution

With third party cookies disappearing, contextual signals are becoming primary targeting methods. Pulse demonstrates this shift with AI-powered video content analysis that detects logos, objects, scenes, and emotions for precision placement without cookie dependency.

CTV and Streaming Growth

Connected TV continues explosive growth as viewing shifts from linear to streaming. CTV ad spending is projected to hit $45 billion by 2026, making platforms like Unwire essential for reaching premium lean-back audiences.

Retail Media Expansion

First party purchase data from retailers creates powerful targeting opportunities. Retail media networks leverage DSP technology to connect advertiser demand with shopper intent data.

Sustainability Focus

Green supply path optimization reduces carbon footprint by eliminating unnecessary intermediaries. Xaprio DSP incorporates environmental efficiency as a core feature, optimizing media routes for transparency and sustainability.

Making Your Platform Decision

Choose Ad Networks If You:

- Spend less than $5,000 monthly on digital advertising

- Need simplified campaign management with dedicated account support

- Target niche vertical audiences through specialized networks

- Must access premium publishers who do not participate in programmatic markets

- Prefer hands-off execution with minimal technical requirements

Choose DSPs If You:

- Spend $3,000 or more monthly on digital advertising

- Need precise audience targeting using first party data

- Want complete transparency into placement performance and costs

- Compete in fast-moving markets requiring real-time optimization

- Run campaigns across multiple channels (CTV, Display, Mobile, Video, Native)

- Value brand safety verification and fraud prevention

- Seek sustainable advertising with green supply path optimization

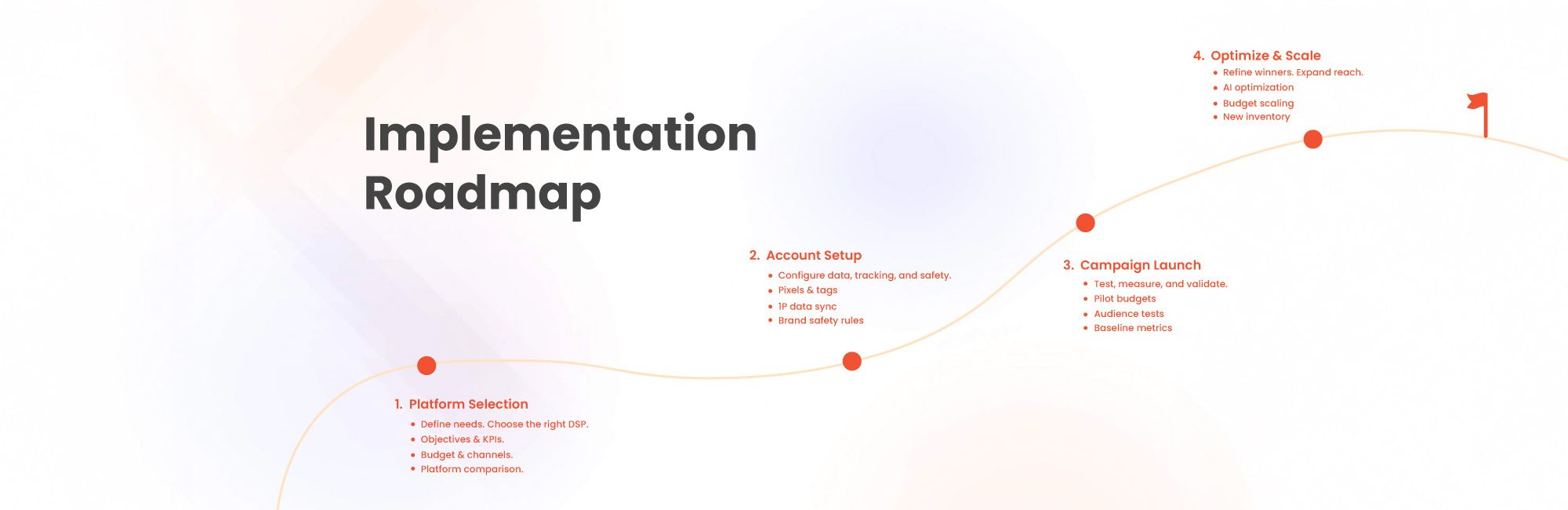

Implementation Roadmap: Getting Started

Phase 1: Platform Selection (Week 1)

Evaluate Requirements:

- Define campaign objectives and KPIs

- Assess available budget and team capabilities

- Identify priority channels (CTV, Mobile, Display, Video)

- Determine targeting complexity needs

Research Platforms:

- Compare features across DSP options

- Review case studies and performance benchmarks

- Request demos from platforms like Xaprio, Xerxes, and competitors

- Verify brand safety and fraud prevention capabilities

Phase 2: Account Setup (2-3 Days)

Technical Configuration:

- Set up tracking pixels and conversion tags

- Integrate first party data sources

- Configure brand safety filters and blocking parameters

- Establish reporting dashboards and KPI monitoring

Audience Development:

- Build initial audience segments

- Upload customer lists for targeting and lookalikes

- Define contextual targeting parameters

- Set frequency caps and budget controls

Phase 3: Campaign Launch (2 days)

Initial Testing:

- Start with limited budgets across key channels

- Test multiple audience segments and creative variations

- Monitor performance closely during first week

- Document learnings and optimization opportunities

Measurement Setup:

- Establish baseline performance metrics

- Configure attribution tracking across touchpoints

- Set up automated reporting schedules

- Define escalation procedures for performance issues

Phase 4: Optimization and Scale (Weeks 3-4)

Performance Refinement:

- Analyze early results and adjust strategies

- Implement automated optimization rules

- Expand successful tactics across additional inventory

- Test new formats and channels based on learnings

Budget Expansion:

- Increase spend on best performing channels and audiences

- Add new inventory sources and publisher partnerships

- Refine creative based on engagement data

- Scale winning combinations while maintaining efficiency

Conclusion: The Clear Winner for Performance-Focused Advertisers

The data shows an undeniable trend. Programmatic advertising reached $802.34 billion in 2024 and will account for 90% of global digital display ad spending by 2026. DSPs deliver superior performance across every meaningful metric including cost efficiency, targeting precision, campaign transparency, and optimization capability.

The advertisers succeeding in 2026 use DSP technology to:

- Access premium inventory across CTV, Display, Mobile, Video, and Native formats

- Target audiences using first party data in privacy-compliant ways

- Optimize campaigns with AI and machine learning automation

- Measure true impact across the full customer journey

- Reduce environmental footprint through green supply path optimization

Platforms like Xaprio DSP make advanced programmatic technology accessible with features including CTV-first buying, omnichannel campaign management, green supply paths, and integrated brand safety. Xapads Media’s ecosystem provides comprehensive solutions across branding, performance, and contextual targeting through specialized platforms including Xerxes, Pulse, and Unwire.

The question is not whether to transition from ad networks to DSPs. The question is how quickly you can adopt programmatic technology before competitors gain advantage through better targeting, lower costs, and superior measurement.